LTA to take over rail assets in move to improve service

It'll buy over SMRT's assets and charge licence fee, allowing operator to focus on service

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 16 Jul 2016

After more than four years of intense negotiations, the Government and rail operator SMRT Corp have reached an agreement to switch to a dramatically different arrangement that is designed to improve service standards.

The Ministry of Transport (MOT) said yesterday that the Land Transport Authority will take over all operating assets of the North-South, East-West and Circle lines, as well as the Bukit Panjang LRT Line, from SMRT for $1.06 billion. This is the net book value - or current value - of the assets, plus GST.

It'll buy over SMRT's assets and charge licence fee, allowing operator to focus on service

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 16 Jul 2016

After more than four years of intense negotiations, the Government and rail operator SMRT Corp have reached an agreement to switch to a dramatically different arrangement that is designed to improve service standards.

The Ministry of Transport (MOT) said yesterday that the Land Transport Authority will take over all operating assets of the North-South, East-West and Circle lines, as well as the Bukit Panjang LRT Line, from SMRT for $1.06 billion. This is the net book value - or current value - of the assets, plus GST.

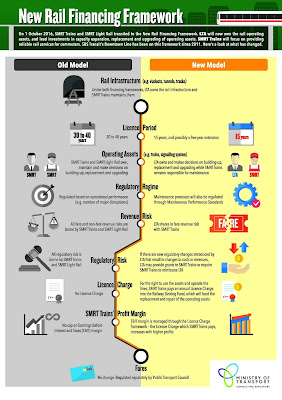

In turn, SMRT will run the trains on these lines and retain a share of the earnings. But it will have to pay a licence charge to LTA annually. The fee, which varies according to SMRT's profitability, will go into a sinking fund for asset replacement.

The operator will also have to abide by a more stringent maintenance regimen, as well as higher service standards. If it fails to do so, it faces more financial penalties on top of the ones currently in place.

To reflect its asset-light status, SMRT is expected to post an average Ebit (earnings before interest and taxes) margin of 5 per cent - about one-third of what it made in the last five years.

The new framework will also have a risk-and reward-sharing formula. If SMRT makes substantially more, the Government can cream off some in the form of a higher licence fee. But if its margin is crimped by new regulations or fare changes, the fee can likewise be reduced.

Asked why the Government is not applying the same model as the new government bus contracts, where operators bid to run services for a fixed fee and the LTA collects all fare revenue, MOT Permanent Secretary Pang Kin Keong said: "It was a judgment call. We wanted to have the operator to still have some skin in the game.

"We wanted them to do things that will attract ridership."

Pending approval from its shareholders, SMRT will start a new 15-year contract from Oct 1. It will thus operate the four lines up till 2031, with an option for a five-year extension. Under the current system, SMRT's contract for North- South and East-West lines and Bukit Panjang LRT expires in 2028, while its Circle Line deal expires in 2019. Both come with an option for a 30-year extension.

The shorter tenure now makes it easier for the LTA to replace an operator with consistently poor performance.

SMRT said yesterday that the current system has become "unsustainable", as it is obliged to comply with changes in regulatory standards "at its own cost". Over the next five years, it estimates that its capital expenditure could reach $2.8 billion.

SMRT chief executive Desmond Kuek said the new framework will allow the company "to better focus on fulfilling its role as a public transport operator to deliver high levels of operational reliability, safety, and service for the benefit of our commuters".

SMRT said yesterday that the current system has become "unsustainable", as it is obliged to comply with changes in regulatory standards "at its own cost". Over the next five years, it estimates that its capital expenditure could reach $2.8 billion.

SMRT chief executive Desmond Kuek said the new framework will allow the company "to better focus on fulfilling its role as a public transport operator to deliver high levels of operational reliability, safety, and service for the benefit of our commuters".

SMRT will call for an extraordinary general meeting soon to seek shareholders' approval for the proposed asset sale to LTA. It said it does not intend to distribute the proceeds of the sale in the form of a special dividend.

Transport minister Khaw Boon Wan lists benefits of LTA’s $1 billion take over of SMRT’s rail assets

Commuters will benefit from increased rail reliability and reduced crowding, he says

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 16 Jul 2016

Transport Minister Khaw Boon Wan believes the new rail financing framework will benefit commuters.

"It will allow the Land Transport Authority (LTA) to add trains to respond more quickly to demand, and to replace and upgrade existing rail assets in a more timely manner," he said.

"This should achieve the twin objectives of raising rail reliability and reducing crowdedness."

Mr Khaw noted that the new framework was first implemented for SBS Transit's Downtown Line.

Commuters will benefit from increased rail reliability and reduced crowding, he says

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 16 Jul 2016

Transport Minister Khaw Boon Wan believes the new rail financing framework will benefit commuters.

"It will allow the Land Transport Authority (LTA) to add trains to respond more quickly to demand, and to replace and upgrade existing rail assets in a more timely manner," he said.

"This should achieve the twin objectives of raising rail reliability and reducing crowdedness."

Mr Khaw noted that the new framework was first implemented for SBS Transit's Downtown Line.

"We now look forward to its extension to all the SMRT train lines," he said, adding: "The new rail financing framework will benefit commuters."

Mr Sitoh Yih Pin, chairman of the Government Parliamentary Committee for Transport, concurs. He said the operator will be able to focus on service to commuters and maintenance of the rail system.

Mr Sitoh Yih Pin, chairman of the Government Parliamentary Committee for Transport, concurs. He said the operator will be able to focus on service to commuters and maintenance of the rail system.

"There will be no more large capital expenditures for the operator," he said.

Mr Sitoh added that the new format also paves the way for "greater contestability".

"The reduction of the licence period to 15 years will hopefully translate to more competition, improved service levels and cost-efficiency," he said.

In a Facebook post, National Transport Workers' Union executive secretary Melvin Yong said the union will study the new arrangement "in greater detail to assess its implications on our rail workers".

SIM University senior lecturer Park Byung Joon said the new framework translates to "more public funding and accountability".

"The responsibility to invest in assets to improve the system now lies with the Government," he said.

"Although there is no guarantee that this will lead to better service, there is no reason to doubt that it won't," he added.

National University of Singapore transport researcher Lee Der- Horng said: "I think commuters will benefit if it all goes as planned. Hopefully, the operator can focus more on operations, and the Government can make the right judgment on the upgrade and renewal of the system.

"In a way, it is like getting the best of both worlds."

Professor Lee, however, said he was surprised that SMRT was willing to settle for a substantially thinner profit margin in the new framework.

SMRT is expected to get an Ebit (earnings before interest and taxes) margin of 5 per cent on average, compared with the more than 15 per cent it has been getting on average in the last five years.

DBS Equity Research senior vice-president Andy Sim said that may not necessarily be a bad thing.

He said that as "compensation", SMRT is "released from capital expenditure, which is a positive".

"This will lead to more stable financials going forward," he said. "But we will have to examine the details more closely to have a better idea of the exact impact."

The analyst also said SMRT's statement on not distributing the proceeds of the asset sale - more than $1 billion - to shareholders in the form of a special dividend is "somewhat of a disappointment".

Mr Sim's last recommendation for the stock, put out in April, was "hold", with a target price of $1.53. Yesterday, SMRT hit $1.54 before trading was suspended at noon.

Mr Sim's last recommendation for the stock, put out in April, was "hold", with a target price of $1.53. Yesterday, SMRT hit $1.54 before trading was suspended at noon.

SMRT will still shoulder significant risks, says its CEO

By Karamjit Kaur Senior Correspondent and Marissa Lee, The Straits Times, 16 Jul 2016

While the new rail financing framework means that SMRT gets some protection in terms of fare revenue and profitability, the company will still be shouldering "significant risks", said the operator's president and group chief executive officer, Mr Desmond Kuek.

"We are still not in control of fares and we don't have all the visibility over ridership going forward or the impact that new lines will have on our existing lines in terms of ridership and the total revenue that might be collectible under our existing lines...

"There continues to be significant risks for us which we have very little control over," he said.

For investors, the news will likely come as a relief from the growing uncertainty of SMRT's finances. SMRT itself admitted yesterday that the current model is an "unsustainable" one.

Noted DBS Equity Research senior vice-president Andy Sim yesterday: "(With SMRT) released from capital expenditure, which is a positive... this will lead to more stable financials going forward."

UOB Kay Hian Research's Andrew Chow said that "overall", it is a positive move, adding that it will free SMRT from a heavy capital expenditure commitment.

Speaking to reporters and analysts at a briefing last evening after the Land Transport Authority announced that it will take over all of SMRT's operating assets to free the operator to focus on service levels, Mr Kuek said the upside is the risk-sharing element built into the new framework. This "was never there before", he said.

With the new deal, LTA will shoulder some of the financial burden if earnings (before taxes and interest) fall below a certain level.

By Karamjit Kaur Senior Correspondent and Marissa Lee, The Straits Times, 16 Jul 2016

While the new rail financing framework means that SMRT gets some protection in terms of fare revenue and profitability, the company will still be shouldering "significant risks", said the operator's president and group chief executive officer, Mr Desmond Kuek.

"We are still not in control of fares and we don't have all the visibility over ridership going forward or the impact that new lines will have on our existing lines in terms of ridership and the total revenue that might be collectible under our existing lines...

"There continues to be significant risks for us which we have very little control over," he said.

For investors, the news will likely come as a relief from the growing uncertainty of SMRT's finances. SMRT itself admitted yesterday that the current model is an "unsustainable" one.

Noted DBS Equity Research senior vice-president Andy Sim yesterday: "(With SMRT) released from capital expenditure, which is a positive... this will lead to more stable financials going forward."

UOB Kay Hian Research's Andrew Chow said that "overall", it is a positive move, adding that it will free SMRT from a heavy capital expenditure commitment.

Speaking to reporters and analysts at a briefing last evening after the Land Transport Authority announced that it will take over all of SMRT's operating assets to free the operator to focus on service levels, Mr Kuek said the upside is the risk-sharing element built into the new framework. This "was never there before", he said.

With the new deal, LTA will shoulder some of the financial burden if earnings (before taxes and interest) fall below a certain level.

However, there is less upside for SMRT because once earnings are higher than a stipulated level, as much as 95 per cent of the excess will go back to the LTA.

Mr Kuek noted that SMRT's rail business has faced declining profitability since 2012 and it would not have been possible for the firm to sustain its financial obligations and the heavy capital expenditures required by an expanded and ageing network. For example, maintenance-related expenses increased to reach 45 per cent of rail fare revenue in the 2016 financial year.

The cost of meeting "heightened regulatory standards" has also increased, he said. On the other hand, fares have gone up by just 1 per cent year-on-year in the last five years.

The new framework will not impact fares, which continue to be regulated by the Public Transport Council, the LTA said. This will be based on the current fare adjustment formula, which expires next year.

With SMRT set to receive $1.06 billion (with GST) for the transfer of assets, shareholders may be disappointed to learn that they will not be getting any special dividends. Instead, SMRT intends to use the money mainly to boost service levels and reliability, including hiring more maintenance staff, Mr Kuek said.

At least 700 will be hired over the next three years. This is on top of the 30 per cent increase in technical workforce that SMRT has made in the last three years, he added.

SMRT also plans to pare some of its total debt as well.

SMRT had called for a trading halt before the announcement was made, and its shares last traded at $1.545. Although investors will not get a special dividend, they may still welcome the news when trading resumes on Monday.

Rival SBS Transit saw its shares close 8.9 per cent higher yesterday, possibly because of news that it is in talks with LTA regarding a similar transfer of its lines.

Rival SBS Transit saw its shares close 8.9 per cent higher yesterday, possibly because of news that it is in talks with LTA regarding a similar transfer of its lines.

An equitable deal with focus on commuter welfare

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 16 Jul 2016

That the creation of a new rail financing framework spanned the tenure of three transport ministers underscores the complexity of arriving at a deal that is equitable to both operator and state.

But the real focus of the deal has always been the welfare of the commuter, as it should be.

Mooted in 2008 when Mr Raymond Lim helmed the transport portfolio, and passed in Parliament in 2010, the new framework allows the state to assume a more direct and active role in funding operating assets such as trains and engineering equipment.

This paves the way for a more timely replacement and upgrading of assets. At the same time, it frees the operator from heavy and lumpy capital expenditures so that it can focus fully on meeting service standards and maintaining the system in good running order.

The capital expenditure issue can be a contentious one. It was a recurring topic during the public inquiry into the December 2011 breakdowns, a proceeding which concluded that SMRT had not done enough to keep the system in acceptable running order.

This was denied strongly by the previous management.

But even the new management has come out several times to say that the current framework is not sustainable.

In April, chief executive Desmond Kuek said that the company was hoping for a system that would help distribute revenue risk, which was "entirely borne by SMRT".

It looks like Mr Kuek got what he wanted. The new framework embodies a risk-and-reward- sharing formula. If SMRT makes substantially more, the Government can cream off some in the form of a higher licence fee. But if its margin is crimped by new regulations or fare changes, the fee can likewise be reduced.

Together with the bus contracting system, it symbolises a sea change for a government that has long been loath to take revenue risk.

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 16 Jul 2016

That the creation of a new rail financing framework spanned the tenure of three transport ministers underscores the complexity of arriving at a deal that is equitable to both operator and state.

But the real focus of the deal has always been the welfare of the commuter, as it should be.

Mooted in 2008 when Mr Raymond Lim helmed the transport portfolio, and passed in Parliament in 2010, the new framework allows the state to assume a more direct and active role in funding operating assets such as trains and engineering equipment.

This paves the way for a more timely replacement and upgrading of assets. At the same time, it frees the operator from heavy and lumpy capital expenditures so that it can focus fully on meeting service standards and maintaining the system in good running order.

The capital expenditure issue can be a contentious one. It was a recurring topic during the public inquiry into the December 2011 breakdowns, a proceeding which concluded that SMRT had not done enough to keep the system in acceptable running order.

This was denied strongly by the previous management.

But even the new management has come out several times to say that the current framework is not sustainable.

In April, chief executive Desmond Kuek said that the company was hoping for a system that would help distribute revenue risk, which was "entirely borne by SMRT".

It looks like Mr Kuek got what he wanted. The new framework embodies a risk-and-reward- sharing formula. If SMRT makes substantially more, the Government can cream off some in the form of a higher licence fee. But if its margin is crimped by new regulations or fare changes, the fee can likewise be reduced.

Together with the bus contracting system, it symbolises a sea change for a government that has long been loath to take revenue risk.

This sets the stage for more stable earnings for SMRT, even if its profit margin won't be as fat as before.

Shareholders may baulk initially at a 5 per cent Ebit (earnings before interest and taxes) margin, but they should be glad their company will be financially stable in the long term.

Previously, management might have been tempted to hold back on capital expenditure to distribute more dividends. Such a policy will lead to only one outcome over time.

But going forward, stakeholders won't have to worry about a company torn between appeasing shareholders in the short term and sustainability in the longer run.

In a way, shareholders would be invested in an entity that is more sound and more focused on serving its customers. And that can only be a good thing, because what is good for the customer will eventually be good for shareholders.

Think of companies like Google, Microsoft, Apple and Toyota.

So, can SMRT customers - its commuters - really look forward to better service? While proof of the pudding is in the eating, they can be sure that a government which bears a much heavier financial responsibility in the new set-up will work harder to ensure the operator keeps its end of the bargain.

Think of companies like Google, Microsoft, Apple and Toyota.

So, can SMRT customers - its commuters - really look forward to better service? While proof of the pudding is in the eating, they can be sure that a government which bears a much heavier financial responsibility in the new set-up will work harder to ensure the operator keeps its end of the bargain.

For starters, SMRT has said that it will ramp up its maintenance staff by 20 per cent - or 700 people - over the next three years. This follows an expansion which saw its total staff strength rising by nearly 30 per cent from 7,000 in 2012 to more than 9,000 today.

If the employees are well trained and empowered, the company is on track to greater things. Because what is good for employees is usually good for customers and shareholders, eventually.

But if one were to look at a longer timeline, a different picture emerges. Over the last 10 years, SMRT's price averaged $1.64. The offer is only 2.4 per cent higher than that. And as the counter has been suspended since just before details of the new rail financing framework were announced last Friday, no one knows how that landmark framework would have affected SMRT's market valuation.

Related

SMRT trains and SMRT light rail to transit to new rail financing framework -15 Jul 2016

Temasek and SMRT Jointly Undertake to Privatise SMRT -20 Jul 2016

If the employees are well trained and empowered, the company is on track to greater things. Because what is good for employees is usually good for customers and shareholders, eventually.

* Temasek makes $1.18 billion buyout offer for SMRT

Investment company offering $1.68 a share, a premium over last closing price of $1.545

By Chia Yan Min, Economics Correspondent and Marissa Lee, The Straits Times, 21 Jul 2016

Temasek Holdings is buying out troubled transport firm SMRT, which has seen multiple breakdowns on its lines in the past few years.

Temasek said yesterday it is offering $1.68 a share - a premium over the firm's last closing price of $1.545 - in a deal that will cost the investment company $1.18 billion.

A successful buyout will see SMRT delisted from the Singapore Exchange (SGX), 16 years after it went public.

The deal has been structured as a scheme of arrangement. This means a majority of the shareholders who hold at least 75 per cent of shares must approve the deal or the offer will fall through. This will take place at a meeting likely to be convened some time in October, and Temasek cannot vote.

Temasek said it will not revise its offer price. It will have to wait a year to try again if the offer fails.

The buyout announcement yesterday comes on the heels of the announcement of a new rail financing framework (NRFF) last Friday. This will involve SMRT disposing of its rail assets to the Land Transport Authority (LTA) for close to $1 billion. In return, SMRT will pay a licence fee to the LTA for the rights to operate the lines with effect from Oct 1.

Investment company offering $1.68 a share, a premium over last closing price of $1.545

By Chia Yan Min, Economics Correspondent and Marissa Lee, The Straits Times, 21 Jul 2016

Temasek Holdings is buying out troubled transport firm SMRT, which has seen multiple breakdowns on its lines in the past few years.

Temasek said yesterday it is offering $1.68 a share - a premium over the firm's last closing price of $1.545 - in a deal that will cost the investment company $1.18 billion.

A successful buyout will see SMRT delisted from the Singapore Exchange (SGX), 16 years after it went public.

The deal has been structured as a scheme of arrangement. This means a majority of the shareholders who hold at least 75 per cent of shares must approve the deal or the offer will fall through. This will take place at a meeting likely to be convened some time in October, and Temasek cannot vote.

Temasek said it will not revise its offer price. It will have to wait a year to try again if the offer fails.

The buyout announcement yesterday comes on the heels of the announcement of a new rail financing framework (NRFF) last Friday. This will involve SMRT disposing of its rail assets to the Land Transport Authority (LTA) for close to $1 billion. In return, SMRT will pay a licence fee to the LTA for the rights to operate the lines with effect from Oct 1.

While this frees SMRT from heavy capital expenditure, SMRT said the new framework poses challenges.

SMRT chief executive Desmond Kuek said last night that significant business risks remain and "many factors are outside the control of SMRT", such as uncertainty over future fare increases and ridership numbers. He said: "The key difference between being publicly listed and privatised is the ability to think long term."

SMRT chairman Koh Yong Guan agreed: "Taking the company private will allow SMRT to better fulfil its role as a public transport operator without the pressure of short-term market expectations."

SMRT's earnings might be hit in the short term as it makes the necessary investments, but Temasek is taking a long-term view, said Temasek International president Chia Song Hwee.

He noted that the sustainability of SMRT's business was a key consideration for Temasek, adding: "In the short run, there will be pressure on the bottom line, but there are plans to improve service quality and productivity. We have no intention of losing money (by taking SMRT private), though as with all investments, there are risks."

Mr Chia also said Temasek "fully supports the management and board in going through with their plans", noting that "Temasek is an active investor but we're not an operator".

A trading halt of SMRT's shares was called last Friday. Trading resumes today.

Mr Chia also said Temasek "fully supports the management and board in going through with their plans", noting that "Temasek is an active investor but we're not an operator".

A trading halt of SMRT's shares was called last Friday. Trading resumes today.

Temasek's $1.18 billion buyout offer for SMRT: A positive move with a puzzling twist

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 21 Jul 2016

Infineon, Veolia, Linktone, Konami and various other companies that have sought to delist from various bourses in recent times cited substantial cost savings as a primary reason for doing so.

Yet, when asked what savings SMRT would achieve if it was taken off the stock exchange, the company said it had not thought about it.

Instead, the rail operator and its main shareholder, Temasek Holdings, focused on why the offer price of $1.68 a share was fair, how SMRT would continue to face huge business uncertainties, and noted that shareholders might not have another chance like this to cash out.

If a casual investor was in the room, he would have come away with an overwhelming impression that the joint briefing was designed to talk down the valuation of SMRT.

On paper, the offer price by Temasek for the 46 per cent of SMRT shares it does not own represents a 15 per cent premium over its 52-week average price.

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 21 Jul 2016

Infineon, Veolia, Linktone, Konami and various other companies that have sought to delist from various bourses in recent times cited substantial cost savings as a primary reason for doing so.

Yet, when asked what savings SMRT would achieve if it was taken off the stock exchange, the company said it had not thought about it.

Instead, the rail operator and its main shareholder, Temasek Holdings, focused on why the offer price of $1.68 a share was fair, how SMRT would continue to face huge business uncertainties, and noted that shareholders might not have another chance like this to cash out.

If a casual investor was in the room, he would have come away with an overwhelming impression that the joint briefing was designed to talk down the valuation of SMRT.

On paper, the offer price by Temasek for the 46 per cent of SMRT shares it does not own represents a 15 per cent premium over its 52-week average price.

But if one were to look at a longer timeline, a different picture emerges. Over the last 10 years, SMRT's price averaged $1.64. The offer is only 2.4 per cent higher than that. And as the counter has been suspended since just before details of the new rail financing framework were announced last Friday, no one knows how that landmark framework would have affected SMRT's market valuation.

Sure, analysts have largely been pessimistic, with most revising their target price downwards. Still, the market has been known to have its own gut instincts.

On May 20, 2014, when rumours emerged that the Government would restructure the bus industry, SMRT's share price shot up by 14 cents or 10.9 per cent to reach an 11-month high of $1.48. It was among the day's top gainers.

In essence, the new rail financing framework is not unlike the bus industry revamp. In both cases, the Government takes over the operating assets, freeing the operator from hefty and often lumpy capital expenditures.

It is a positive move that will make SMRT a more sustainable business in the long run. That much, the management acknowledges.

So it is puzzling that the operator and its main shareholder were not more upbeat about the transition.

It is equally puzzling that Temasek has not made a general offer. Instead, it has effected a scheme of arrangement, which is often associated with mergers or the restructuring of a troubled entity.

In the scheme of arrangement, Temasek would require a 75 per cent acceptance rate, versus 90 per cent for a general offer. By virtue of that, it is likely it would have had to offer a better price for a general offer. Temasek said it picked a scheme of arrangement because it was not looking to raise its shareholding (54 per cent), but instead wanted to delist the firm. Still, no one would have stopped it if it had chosen to make a general offer.

It is interesting that Temasek's $1.68 offer would amount to a total consideration of $1.1 billion, which is almost identical to the sum that the Government has agreed to pay for SMRT's operating assets.

Does that mean the state will eventually be financing Temasek's buyout? If one were to see Temasek and the state as being different parts of the same machinery, that question does not matter.

Many shareholders will no doubt see the $1.68 offer as low, especially if they had bought the stock between 2007 and 2011. Still, they might change their minds once trading resumes today. With Temasek's non-revisable offer on the table, it is unlikely it will rise above $1.68.

Then again, those who view the cup as half full might say the stock would not plunge for the same reason.

Then again, those who view the cup as half full might say the stock would not plunge for the same reason.

Two operators, different tracks

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 22 Jul 2016

Shifting our rail operations to a completely new financing framework and delisting our main rail operator is not something we see every day.

It has taken us 16 years to realise that having an entity juggling the interests of shareholders and commuters is just too daunting.

Not that it is impossible, as shown by Hong Kong's MTR Corp, which listed in the same year as SMRT.

MTR's operating model is different from SMRT's though. The Hong Kong operator is also involved in building rail infrastructure and, in turn, is given development rights to properties along the metro lines.

This makes it less dependent on fare revenue. In fact, in the early years, there were no fare rises.

Just last month, McKinsey described MTR's rail-plus-property model as a "successful self-financing formula".

"Hong Kong's MTR Corp has defied the odds and delivered significant financial and social benefits: excellent transit, new and vibrant neighbourhoods, opportunities for real estate developers and small businesses, and the conservation of open space," it wrote in a report.

And because builder and operator are one entity (with interests aligned), the model has led to a network that is superior in design and build quality.

Singapore, however, prefers to accord proceeds from property sales to the Government. The money is kept in reserves for future generations. It is a sound decision, too.

Still, one wonders if there is greater benefit to be had from MTR's model. With the Hong Kong government being the majority shareholder, much of the money flows back to the state coffers anyway.

While that might be worth considering, Singapore's overhaul of the rail industry in the past week is already a monumental change. Without the burden of hefty capital expenditures, SMRT can focus on serving commuters better.

But if the overhaul does not work, let's hope we will flip the switch to change tracks sooner.

By Christopher Tan, Senior Transport Correspondent, The Straits Times, 22 Jul 2016

Shifting our rail operations to a completely new financing framework and delisting our main rail operator is not something we see every day.

It has taken us 16 years to realise that having an entity juggling the interests of shareholders and commuters is just too daunting.

Not that it is impossible, as shown by Hong Kong's MTR Corp, which listed in the same year as SMRT.

MTR's operating model is different from SMRT's though. The Hong Kong operator is also involved in building rail infrastructure and, in turn, is given development rights to properties along the metro lines.

This makes it less dependent on fare revenue. In fact, in the early years, there were no fare rises.

Just last month, McKinsey described MTR's rail-plus-property model as a "successful self-financing formula".

"Hong Kong's MTR Corp has defied the odds and delivered significant financial and social benefits: excellent transit, new and vibrant neighbourhoods, opportunities for real estate developers and small businesses, and the conservation of open space," it wrote in a report.

And because builder and operator are one entity (with interests aligned), the model has led to a network that is superior in design and build quality.

Singapore, however, prefers to accord proceeds from property sales to the Government. The money is kept in reserves for future generations. It is a sound decision, too.

Still, one wonders if there is greater benefit to be had from MTR's model. With the Hong Kong government being the majority shareholder, much of the money flows back to the state coffers anyway.

While that might be worth considering, Singapore's overhaul of the rail industry in the past week is already a monumental change. Without the burden of hefty capital expenditures, SMRT can focus on serving commuters better.

But if the overhaul does not work, let's hope we will flip the switch to change tracks sooner.

What the likely privatisation of SMRT means

By Yasmine Yahya, Assistant Business Editor, The Straits Times, 22 Jul 2016

Temasek Holdings' bid to take over SMRT has been termed a "privatisation", but what does that really mean and how is it different from nationalisation?

Experts say that in this case, it simply means that if the bid succeeds, SMRT would be a closely held firm that is not listed on the Singapore Exchange.

And it is not a nationalisation because Temasek owns assets at arm's length from the Government.

"Privatisation in the context of a takeover transaction means the delisting of a company and turning it into a closely held company, owned by one or a few shareholders," noted Mr Lean Min-tze, a principal at law firm Baker & McKenzie.Wong & Leow.

"In Singapore, a private company cannot have more than 50 shareholders."

Law firm Lee & Lee's senior partner Adrian Chan said: "Unlike what many people might think, Temasek is not part of the Government. It is a separately-run fund with its own investment goals to meet."

Dr Walter Theseira, a senior lecturer at SIM University, agreed.

By Yasmine Yahya, Assistant Business Editor, The Straits Times, 22 Jul 2016

Temasek Holdings' bid to take over SMRT has been termed a "privatisation", but what does that really mean and how is it different from nationalisation?

Experts say that in this case, it simply means that if the bid succeeds, SMRT would be a closely held firm that is not listed on the Singapore Exchange.

And it is not a nationalisation because Temasek owns assets at arm's length from the Government.

"Privatisation in the context of a takeover transaction means the delisting of a company and turning it into a closely held company, owned by one or a few shareholders," noted Mr Lean Min-tze, a principal at law firm Baker & McKenzie.Wong & Leow.

"In Singapore, a private company cannot have more than 50 shareholders."

Law firm Lee & Lee's senior partner Adrian Chan said: "Unlike what many people might think, Temasek is not part of the Government. It is a separately-run fund with its own investment goals to meet."

Dr Walter Theseira, a senior lecturer at SIM University, agreed.

"When a company is nationalised, it comes under the direct control of the government. The nationalised company's assets, liabilities and profit or loss generally become the responsibility of the government," he said.

However, he added, if a Temasek-owned company makes a loss, the Government is not responsible. That is, the Government does not need to make good the losses to Temasek-owned companies from the Budget.

"It is true that if Temasek-owned companies make losses, that eventually does have an impact on Singapore's finances because that erodes the value of our reserves. But the connection happens at arms' length," added Dr Theseira.

Temasek's takeover bid comes just five days after the Government announced that the Land Transport Authority would take over SMRT's operating rail assets.

Now this deal, noted Mr Lean, can be termed nationalisation as it is "a transfer of ownership and control of assets from a commercial entity (SMRT) to the Government (LTA)."

Another interesting aspect of Temasek's privatisation bid, Mr Chan said, is the fact that it is a scheme of arrangement. Under the scheme, a majority of shareholders at a meeting have to vote for the deal in order for it to succeed.

These shareholders will have to hold at least 75 per cent of the value of SMRT shares held by all shareholders present at the meeting.

This offers more certainty to a potential buyer, who will get all or none of the company, than the more common route of launching a general offer.

"Under a general offer, Temasek would technically have had to acquire over 90 per cent of what it did not already own in SMRT, which is a high threshold," noted Mr Chan.

"So there would have been a risk that it would end up with more shares in SMRT, and yet still not be able to take it private."

And so in this case, it is clear that Temasek wants to have SMRT privatised, or else not have more shares in the rail operator than it already has, he said.

The two firms said in a joint statement on Wednesday that privatisation would provide SMRT "greater flexibility to focus on its primary role of delivering safe and high-quality rail service, without short-term pressures of being a listed company".

SMRT trains and SMRT light rail to transit to new rail financing framework -15 Jul 2016

Temasek and SMRT Jointly Undertake to Privatise SMRT -20 Jul 2016

No comments:

Post a Comment