Gan: Don't worry about MediShield Life premiums

Additional one-point CPF contribution and subsidies will cover most households

By Salma Khalik, The Sunday Times, 8 Jun 2014

Additional one-point CPF contribution and subsidies will cover most households

By Salma Khalik, The Sunday Times, 8 Jun 2014

Health Minister Gan Kim Yong yesterday reassured Singaporeans that they do not need to worry about being unable to afford the projected increase in premiums for the new MediShield Life plan.

He said the 1 percentage point increase in employer contribution to Medisave will be enough to offset the rise in premiums for most upper middle-income families.

Middle- and lower-income families will also have no problems as they will get permanent government subsidies.

And for anyone else who may "fall through the cracks", the Government will work out a special scheme to help them, he promised.

MediShield Life is a compulsory scheme that will provide medical insurance for everyone for life - including those already sick - when it starts at the end of next year.

Details of the scheme's enhanced benefits and wider coverage were announced by the MediShield Life Review Committee last Thursday, but there has been no news yet on exactly how much the premiums will cost.

Yesterday, Mr Gan gave some indication, saying that for those earning at least $5,000 - the income cap for calculating Central Provident Fund contributions - the additional 1 percentage point Medisave contribution will provide $600 a year. This will be enough to cover the increase in premiums for most families in that income bracket, he said.

Last Thursday, it was announced that there will be permanent subsidies for two out of three households, and transitional subsidies for everyone for four years. The transitional subsidy starts at 80 per cent of the premium increase in the first year, dropping to 60 per cent, 40 per cent and 20 per cent over the following four years.

"Because this is a very major shift in the health-care financing framework, the Government is committed to providing sufficient help and support," said Mr Gan, who spoke on the sidelines of an event to celebrate World Blood Donor Day at Sentosa. "The idea is to help as many people as we can."

Mr Gan also praised the review committee for its "very impactful" suggestions, such as the removal of the lifetime cap so people will not have to worry about running out of insurance coverage; raising the claims limit so patients can make larger claims; and reducing the co-payment so patients bear a smaller part of big bills.

He expressed his gratitude to the 11-member committee headed by former managing director of accounting giant KPMG, Mr Bobby Chin, who "burned the midnight oil" on many occasions to come up with recommendations that struck a balance between enhancing benefits and maintaining affordability.

The final report from the committee will be submitted to the Government at the end of this month and be debated in Parliament next month.

The minister noted it is important for the economy to continue growing strongly so that there will be enough resources to provide these MediShield Life subsidies.

The final report from the committee will be submitted to the Government at the end of this month and be debated in Parliament next month.

The minister noted it is important for the economy to continue growing strongly so that there will be enough resources to provide these MediShield Life subsidies.

As to whether people should give up their Integrated Shield plans - which cover more than standard subsidised care and cost more - the minister said people will have to make that decision carefully.

He added: "They will have to consider the cost of coverage and the additional premiums, not just when they are young, but... when they get older."

Granting of MediShield Life premium subsidies will be "hassle-free": Amy Khor

By Olivia Siong, Channel NewsAsia, 8 Jun 2014

By Olivia Siong, Channel NewsAsia, 8 Jun 2014

The process of getting premium subsidies for the new MediShield Life scheme will be made as hassle-free and automatic as possible.

That was the assurance given by Senior Minister of State for Health Amy Khor on Sunday.

Those who still cannot afford to pay for premiums even with the subsidies will also get more financial help.

Premiums are expected to go up when MediShield Life kicks in next year.

That's because more benefits are also expected.

But the government has said that it will be providing support to help Singaporeans cope.

Besides the pioneer generation, two-thirds of Singaporean households from the low- and middle- income groups will receive premium subsidies.

Dr Khor said: "We'll make it as hassle free and automatic as far as possible.

"I think the important thing to tell Singaporeans now is we're working out the details, and we'll give the details later when we're ready.

"But we want to assure Singaporeans that we are committed to making sure that the premiums are affordable."

Medisave top-ups will also be provided to the pioneer generation and those aged between 55 and 64.

As for those who may fall through the cracks, more help will be given.

Dr Khor said: "If (after) all these, they are still not able to pay despite the various subsidies that we are giving, then we would help them in terms of financial assistance, something akin to Medifund (for example).

"We would help them. No one would be dropped off from MediShield Life just because they cannot afford to pay."

Dr Khor also noted that premiums will fall within Singaporeans' Medisave contributions.

The increase in premiums will also in most cases be covered by the 1 per cent increase in employer's Medisave contribution, which kicks in next year.

Dr Khor was speaking to the media on the sidelines of a community event for Hong Kah North residents held at the Bird Park on Sunday morning.

She said helping Singaporeans understand the healthcare financing system will also allow them to better plan for their retirement.

Communicating how MediShield Life will work is also key and Dr Khor said it's through community events that key messages can be shared with Singaporeans.

The government is also looking at holding dialogues, producing videos and skits in various languages, as well as, perhaps, comic strips to educate citizens about MediShield Life.

Dr Khor said: "We are painfully aware that the healthcare financing system is not simple for Singaporeans to understand.

"Therefore communication is really very important as we have also indicated for, say, the Pioneer Generation Package.

"It's also important to sustain this over time, because you can't just do it one time (or) ad-hoc.

"You have to do it on a sustained basis in order to deepen outreach and engagement, and also at various points in time when they need certain services."

Authorities will also engage healthcare professionals, voluntary welfare organisations, employers and grassroots organisations to help reach out to Singaporeans from all walks of life.

The scheme was then "losing its effectiveness" - for patients with large hospital bills, MediShield covered only about 40 per cent of the bill.

WHEN Yva Yew was born in 2012, her parents, Mr Yew Poh Cheng and Mrs Lili Yew, felt a mix of joy and fear. Their second daughter had been born with two kidneys on her left side and had complications in her urethra, which led to urine blockages and infections.

Related

MediShield Life will 'better protect against large bills'

By Melody Zaccheus, The Sunday Times, 15 Jun 2014

By Melody Zaccheus, The Sunday Times, 15 Jun 2014

The proposed MediShield Life scheme will "provide far better protection against large bills", said Minister for Culture, Community and Youth Lawrence Wong.

In a post on Facebook yesterday, Mr Wong said he was glad with the recommendations by the MediShield Life Committee, adding that he had helped to implement the first MediShield reform in 2004 as a civil servant.

Post by Lawrence Wong.

The scheme was then "losing its effectiveness" - for patients with large hospital bills, MediShield covered only about 40 per cent of the bill.

After public consultations, the Government decided to increase payouts while keeping the monthly premium increase to about $10. Over time, and with subsequent adjustments, the protection offered by MediShield improved, he wrote.

Mr Wong said he saw the benefits last year when his father suffered a sudden heart attack.

His father had to undergo quadruple bypass surgery and stayed in the hospital for some time. The bill came up to more than $20,000. Insurance covered more than 70 per cent of it while the rest was paid through Medisave and with cash.

"This was better than the old MediShield but it could still have been better," said Mr Wong.

Earlier this month, the Government announced details about MediShield Life - an updated universal health plan which improves on the existing MediShield scheme by lowering out-of-pocket medical expenses due to reduced co-payment rates. The scheme extends coverage for life and covers those with pre-existing conditions.

Mr Wong said premiums can be kept affordable because MediShield Life is a universal scheme which every Singaporean is part of.

"This is important because all of us must bear the responsibility to join the insurance risk pool. It represents a commitment to social solidarity, so that we all chip in to help pay for the health-care needs of the sick," he said.

Employers also contribute with a 1 per cent increase in employer Medisave contributions that will help cover premiums.

The Government is also providing premium subsidies and Medisave top-ups for the pioneer generation for life. Lower- to middle-income households will also benefit from premium subsidies.

Yesterday, at an appreciation dinner for 300 seniors aged 65 and above, Deputy Prime Minister Teo Chee Hean also spoke about MediShield Life. He said it will give pioneers better peace of mind about their health-care bills and will also ease the burden of caregivers and family members.

He told the audience that MediShield Life premiums would be lower than their current MediShield premiums.

He told the audience that MediShield Life premiums would be lower than their current MediShield premiums.

Pioneers will also be able to get annual Medisave top-ups from next month to help pay for these premiums, he said at the event held at Pasir Ris Elias Community Club.

He gave the example of a pioneer in his early 80s who pays $1,123 a year for his MediShield premiums.

"With MediShield Life, his premium is less than $600 a year. He will receive a Medisave top-up of $800 every year, for life, which can more than pay for his MediShield Life premium," said DPM Teo.

"The important message for our pioneers is not all the details but that they should actually worry less because we want them to enjoy their silver years with fewer worries. That's really the main message we want to put across," he said.

Many of the things are taken care of automatically. For instance, no application is required to enrol into MediShield Life, he added.

About 30 grassroots leaders went around to explain to seniors what the changes would mean for them.

After speaking to residents, Mr Teo said they understood the most important thing is that their health care will be better taken care of.

Retired taxi driver Kew Vian Shak, 75, said he is clearer about how the scheme works. "I now know that older people like myself have less to worry about when it comes to medical expenses."

MediShield Life to benefit community hospital patients, say doctors

By Loi Kar Yee, Channel NewsAsia, 7 Jun 2014

Doctors said those who need to stay for a longer period of time in community hospitals can benefit from MediShield Life.

One of the suggestions proposed by the MediShield Life Review Committee is to increase daily claim limits for community hospitals by 40 per cent -- from S$250 to S$350.

By Loi Kar Yee, Channel NewsAsia, 7 Jun 2014

Doctors said those who need to stay for a longer period of time in community hospitals can benefit from MediShield Life.

One of the suggestions proposed by the MediShield Life Review Committee is to increase daily claim limits for community hospitals by 40 per cent -- from S$250 to S$350.

Doctors said this will benefit patients who incur higher expenditure per day as well as those, for example, on dialysis. They also added that dialysis patients at community hospitals can expect a reduced bill size with MediShield Life.

Dr Kelvin Phua, a medical director with Ang Mo Kio-Thye Hua Kwan Hospital, said: "Usually, patients spend about S$150 to S$200 per session of dialysis. The bill size per day will likely be more than S$250. (MediShield Life) will help them pay off this particular part of the bill better.

"Because our patients are generally in the elderly age group, so they have more complicated illnesses and they may stay beyond 30 days. If they stay beyond 30 days, their bill size may be quite large. MediShield Life will also help them pay off part of that bill."

MediShield Life important piece in social security net: Ng Eng Hen

Channel NewsAsia, 8 Jun 2014

Channel NewsAsia, 8 Jun 2014

MediShield Life is an important piece in Singapore's social security net, which is strengthened by schemes like the Workfare Income Supplement and CPF Life.

Defence Minister Ng Eng Hen said this on the sidelines of a community event on Sunday.

“We recognise that government has to do more,” Dr Ng said. “There will be more subsidies under the MediShield Life, and yet at the same time, of course all the individuals must play their part.

“So it's a very important model -- a Singapore model for our healthcare needs, and I believe this strikes a right balance between (the) government doing more, individuals doing their part and, of course, individuals themselves risk pooling some of their health risks and I believe it will make our healthcare system much stronger.”

Dr Ng was speaking at Toa Payoh Central, where he joined more than 300 residents for a 40-storey vertical race.

The event has raised $150,000 in the past two years, and the money will be used to provide enrichment classes for youths living in the neighbourhood.

Relief for future medical bills

MediShield Life cover for child gives her parents some financial assurance

By Kash Cheong, The Straits Times, 10 Jun 2014

MediShield Life cover for child gives her parents some financial assurance

By Kash Cheong, The Straits Times, 10 Jun 2014

WHEN Yva Yew was born in 2012, her parents, Mr Yew Poh Cheng and Mrs Lili Yew, felt a mix of joy and fear. Their second daughter had been born with two kidneys on her left side and had complications in her urethra, which led to urine blockages and infections.

Yva had surgery to correct the problem but bills at KK Women's and Children's Hospital - covering multiple scans, surgery and a two-week stay in an A-class ward - ran up to about $80,000.

The child did not have insurance, not even the basic MediShield, which would cover her up to a B2 ward. She was excluded from MediShield coverage because of her condition.

"I tried so hard to get insurance but nobody would take her on," said Mrs Yew, a 38-year-old human resource manager.

Yva's hospital bills wiped out the couple's savings.

"We were starting a family and we knew we needed to save for many things, like our children's education," said Mrs Yew. "But it was a matter of Yva's health. We just spent first and thought later."

The family delayed plans to move house and buy a family car.

"We just have to save on these luxuries," said Mr Yew, 56, a tour manager.

Last year, MediShield - the insurance scheme which covers Singaporeans for B2 and C Class stays, surgery and selected outpatient treatments - was extended to cover babies born with conditions on or after March 2013, so long as their parents did not opt out of the scheme.

Yva did not qualify as she was born a year earlier. However, a proposed MediShield Life scheme to kick in from next year would cover anyone with pre-existing illnesses, including Yva.

This means that if Yva ever needed to be hospitalised, she would be covered up to a B2 ward. If she needed surgery, MediShield Life could also pay part of her bill.

The couple understand that they may need to pay higher premiums for Yva to reflect her higher risk - an additional 30 per cent for 10 years.

"But at least then, she would have a basic safety net. It's much, much better than nothing," said Mrs Yew.

This would leave the Yew family more financially assured. Mr Yew would consider spending "a little more" on enrichment classes for their first child, Lydia, four, and Mrs Yew said: "We could spend on a holiday or two. That family car would seem closer in sight."

Related

MediShield Life to offer much better benefits for all

MediShield Life Review

MLRC Recommends Significant MediShield Life Enhancements

Government welcomes recommendations by MediShield Life Review Committee; commits support for MediShield Life premiums

MediShield Life Benefits

MediShield Life: 8 Things to Know

How much do Families have to Pay?

Gan: Weigh Cost Benefits of Private Shield Plans

MediShield Life premiums unveiled / MediShield Life premiums to stay the same for 5 years

MediShield Life Review Committee Report

Government accepts recommendations of MediShield Life Review Committee; announces $4 billion in subsidies and support for MediShield Life premiums

MediShield Life

REACH MediShield Life microsite

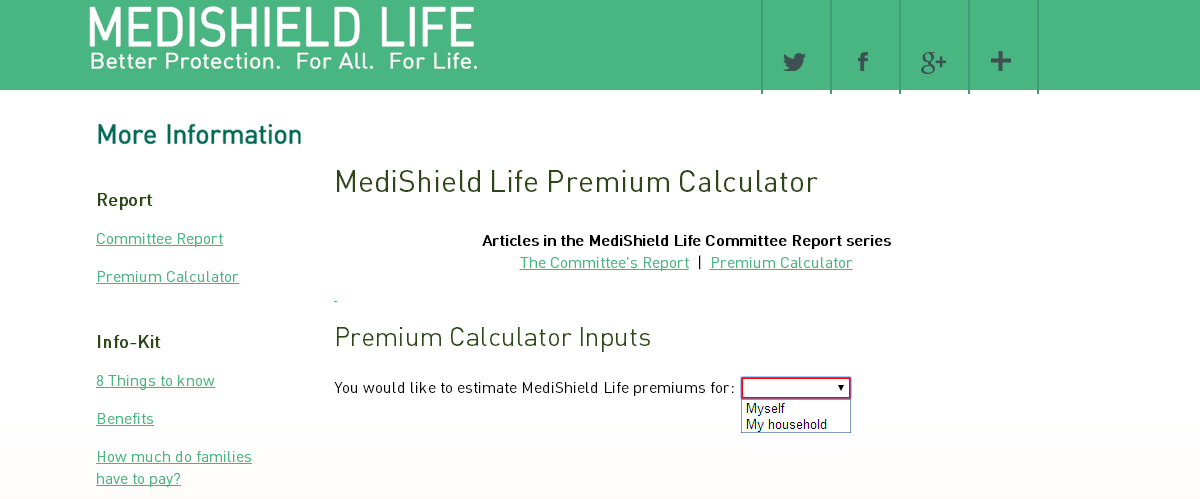

MediShield Life Premium Calculator

MediShield Life Q&A

MediShield Life FAQs

MediShield Life Review

MLRC Recommends Significant MediShield Life Enhancements

Government welcomes recommendations by MediShield Life Review Committee; commits support for MediShield Life premiums

MediShield Life Benefits

MediShield Life: 8 Things to Know

How much do Families have to Pay?

Gan: Weigh Cost Benefits of Private Shield Plans

MediShield Life premiums unveiled / MediShield Life premiums to stay the same for 5 years

MediShield Life Review Committee Report

Government accepts recommendations of MediShield Life Review Committee; announces $4 billion in subsidies and support for MediShield Life premiums

MediShield Life

REACH MediShield Life microsite

MediShield Life Premium Calculator

MediShield Life Q&A

MediShield Life FAQs

No comments:

Post a Comment